Big boost for energy sector recovery as Ghana signs $260m facility with World Bank

)

Signed during the IMF/World Bank Annual Meetings in Washington, DC, the agreement focuses on enhancing revenue collection and improving the quality of energy supply, specifically through investments in prepaid metering and commercial meter management for utilities.

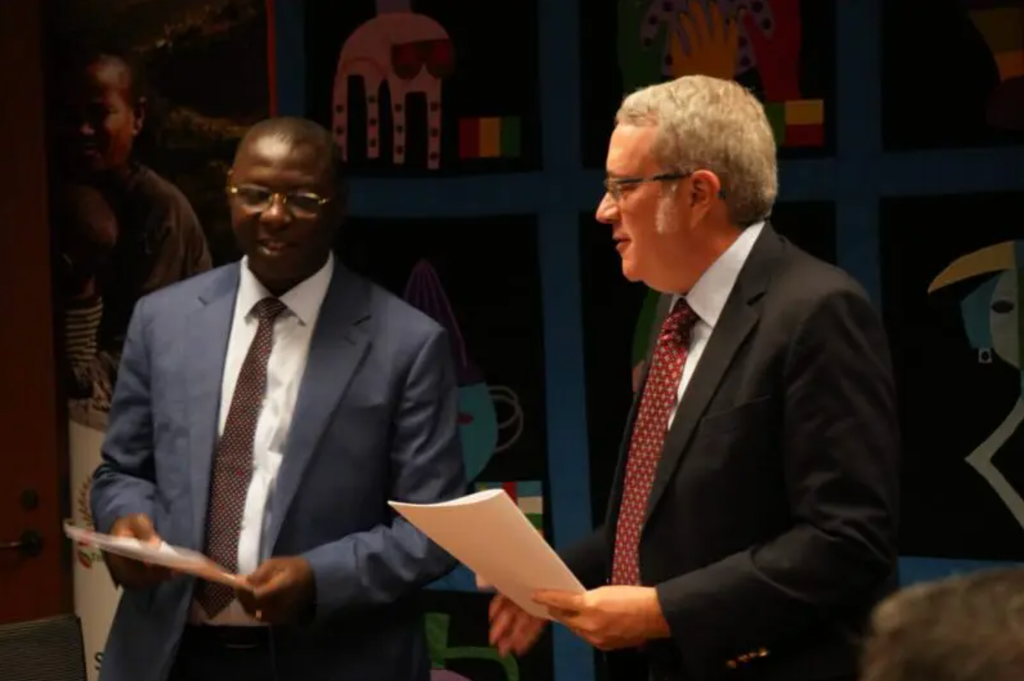

According to myjoyonlin.com, of the total facility, $250 million will be provided as a loan, with an additional $10 million granted to the Ghanaian government. Ghana’s Finance Minister, Dr Mohammed Amin Adam, signed on behalf of the country, while Robert Taliercio O’Brien, the World Bank’s Country Director for Ghana, signed on behalf of the World Bank Group.

Dr Amin Adam noted the timeliness of the results-based financing approach, emphasising that it would address critical issues within the sector and lead to better living conditions for Ghanaians. “This year alone, we have spent about 18 billion cedis to cover energy sector shortfalls, a level of spending that is no longer sustainable,” he stated. The finance minister highlighted the importance of such an investment at this stage in Ghana’s economic recovery and pledged that the facility would be used effectively to achieve its goals.

World Bank Country Director O’Brien reaffirmed the institution's commitment to supporting Ghana’s energy sector through this agreement.

The funding includes $250 million in credit from the International Development Association (IDA) and a $10 million grant from the Energy Sector Management Assistance Program (ESMAP), both approved by the World Bank in June. The four-year Ghana Energy Sector Recovery Programme for Results (PforR) aims to improve the financial sustainability of electricity distribution and expand access to clean cooking solutions.

The programme will also provide direct financing to utilities within the energy sector, supporting their capital expenditure initiatives. Additionally, it complements regulatory and policy reforms aligned with the World Bank’s development policy financing series and the IMF’s Extended Credit Facility.

,fit(112:112))

)

)

,fit(112:112))

)

)