Budget 2022: Finance Minister’s update on Essipon Stadium inaccurate - Joe Ghartey

)

Mr. Ofori-Atta during his budget presentation to Parliament on Wednesday, November 17, noted the rehabilitation works on the Essipon Stadium is 90% completed.

But the MP of the area where the said stadium is located said his checks reveal contrary to the Finance Minister’s claim.

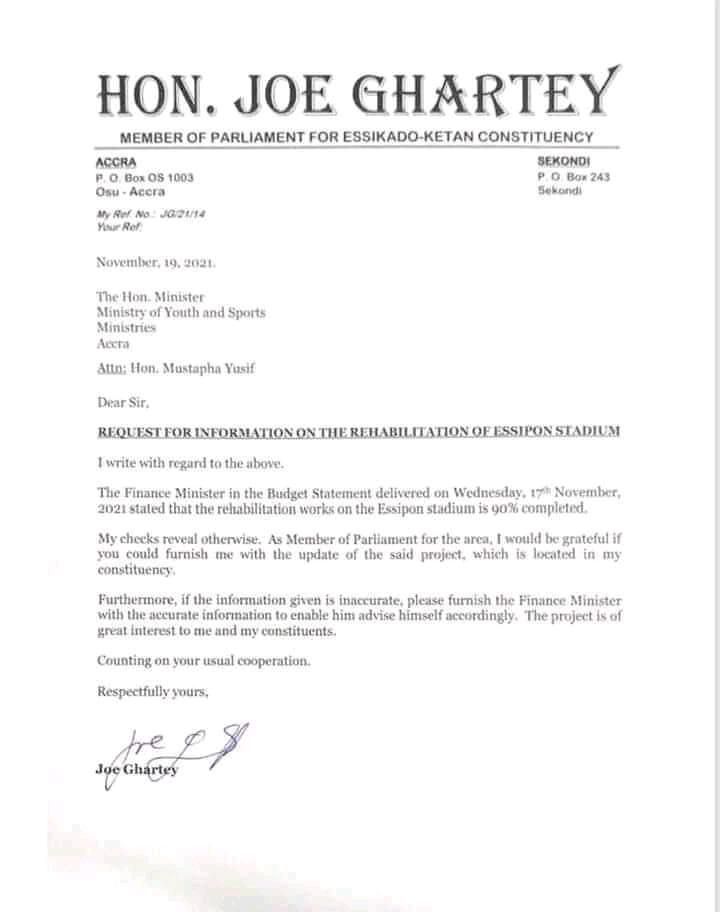

Mr. Ghartey, who himself is a senior member of the governing New Patriotic Party (NPP) in a letter addressed to the Ministry of Youth and Sport is demanding an update on the state of work so far on the Essipon Stadium in his constituency.

“My checks reveal otherwise. As Member of Parliament for the area, I would be grateful if you could furnish me with the update of the said project which is located in my constituency,” portion of the MP's letter read.

Check out Mr. Joe Ghartey’s letter to the Sports Ministry below;

)

)

)

)

)

,fit(112:112))

)

,fit(112:112))

)

,fit(112:112))