Uber, Bolt, Yango set to pay Value Income Tax starting January 1 2024

)

Effective January 1, 2024, this groundbreaking initiative is poised to reshape the financial landscape for vehicle owners associated with popular ride-hailing services like Uber, Yango, and Bolt.

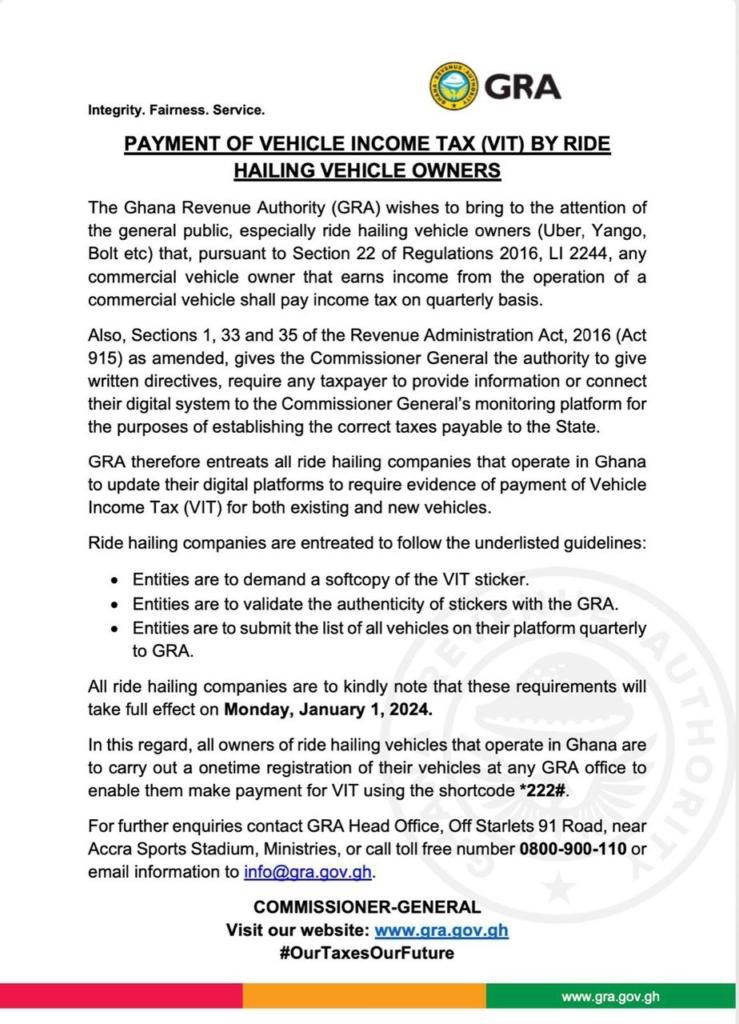

The Ghana Revenue Authority (GRA) has taken the wheel on this transformative journey, citing Section 22 of Regulations 2016, LI 2244.

This section mandates that any commercial vehicle owner deriving income from their vehicle's operation must pay income tax quarterly. The GRA's move aims to ensure that the burgeoning ride-hailing sector contributes its fair share to the nation's coffers.

To comply with these new tax regulations, ride-hailing companies have been urged to swiftly update their digital platforms. Key guidelines include obtaining a softcopy of the VIT sticker, a symbol of compliance, and validating its authenticity with the GRA.

Furthermore, companies must submit a comprehensive quarterly list of all vehicles operating on their platforms.

The GRA's emphasis on the January 1, 2024 enforcement date underscores the seriousness of this tax reform. Ride-hailing giants now find themselves navigating uncharted territory, as they race against time to integrate these changes seamlessly into their operations.

As vehicle owners grapple with the impact of this tax reform, the Ghanaian public watches closely, wondering how this move will influence the affordability and accessibility of ride-hailing services in their daily lives.

Read the GRA's full statement below;

,fit(112:112))

,fit(112:112))

)

,fit(112:112))

,fit(112:112))