Ghana's investment culture and DDEP in a fractured economy

)

For the average Ghanaian, this was somehow the first time they had heard haircut in the context it was being used. Getting a haircut was usual for many. Taking a haircut in financial terms was an alien vocabulary. For most of Twitter, the haircut conversation looked like fun and games. However, when the president of Ghana, Nana Addo Dankwa Akufo-Addo stepped in to address the situation in October 2022, citizens knew it could only get worse.

Financial haircut can be described as the percentage difference between an asset's market value and the value ascribed to that asset for purposes of calculating regulatory capital or loan collateral. There is a difference between these values because market prices change over time, and the lender factors this fluctuation into their valuation and analysis for risk mitigation.

In simple terms, the haircut conversations in Ghana meant people who had some investments in the West African country could lose money. Although investments come with risks, the looming possibility of this risk, most Ghanaians felt, had been triggered by the insensitive nature and mismanagement of the economy by the government.

On Sunday, October 30, 2022, Ghana’s president Nana Addo Dankwa Akufo-Addo addressed the nation in a format that had been synonymous to ‘Fellow Ghanaians’ during the Covid era. His message was simple: no individual or institutional investor was going to lose money or part of their investment in relation to the country’s talks with the International Monetary Fund (IMF) for financial support.

After confirming that talks with the IMF were in advanced stages, President Akufo-Addo added: “No individual or institutional investor will lose their money as a result of our ongoing IMF negotiations. There will be no haircuts.”

The president went ahead to brand the conversations around a possible haircut as ‘false rumours’. By November 29, 2022, 30 days after the president’s assurance of no haircut in the financial sector, the situation had a different twist. Deputy Finance Minister of Ghana, John Kumah announced that the government was considering a 30% haircut on foreign bonds. He later confirmed to Reuters that the considerations were ‘not conclusive’ at the stage. Just a proposal.

Within a week, Ghana’s Finance Minister Ken Ofori-Atta announced a domestic debt exchange programme. This announcement eventually meant a haircut plus complications of different financial realizations and education on government bonds, maturity dates, amortized value and market-to-market value - topics the average Ghanaian investor would rather leave to their investment advisors.

Investment chaos in a poor economy

While all the talks around IMF and a hair were going on, investment banks in Ghana were already updating their customers per new directives from their regulator, Securities and Exchange Commission (SEC). Two of Ghana’s biggest investment firms Stanbic Investment Management Services and Ecobank EDC notified their customers of the economic situation and the impact on their investment via emails and market update notifications.

Although this was a directive from the regulator, one other investment firm, Databank Financial Services took most of the backlash when customers started seeing a difference in their total amortized value and market-to-market value due the financial institution’s link to Ghana’s Minister of Finance as a co-founder (although he is currently not involved in the day to day running of the business).

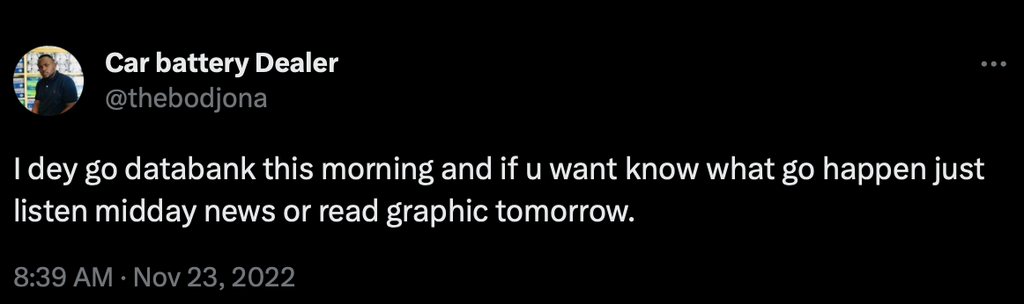

A Ghanaian car battery dealer with X (formerly Twitter) handle @thebodjona wrote on the platform on November 23, 2022: “I dey go databank this morning and if u [you] want know what go happen, just listen to midday news or read graphic tomorrow”

Although @thebodjona would later post on the timeline to calm the situation after his visit, the earlier post had already started a conversation as people shared the differences in their expected investment value and what the market value was.

The entire conversation reeked of investment chaos in an environment that already had a poor investment culture. The conversation eventually moved offline with its impact hurting both old and young, the informed and uninformed in one of Ghana’s biggest financial mess that hit the end consumer real hard.

Ghana’s investment culture

Desmond Bredu is a financial literacy advocate in the investment and asset management industry. During the financial challenges of COVID and the rise in popularity of Twitter (now X) Spaces, the investment professional embarked on a journey to educate young adults in Ghana on personal finance management.

From his YouTube page, TV, events and conferences to periodic Twitter Spaces, Desmond treated topics like ‘How to manage your personal finance’, ‘Budgeting’, ‘Why You Should Not Convert Your Cedis To Dollars’, ‘Unit Trust & Mutual Funds’ and ‘Bonds 101 (A Beginners Guide)’.

The goal was simple for Desmond - to get people to manage their finances well, invest for their future and ultimately be financially independent.

“I am a passionate financial literacy advocate,” Desmond Bredu says.

“I have, over the past years, been embarking on a journey to educate people, especially the youth, on savings, investment, and general personal financial management principles.”

This quest has had its wins and challenges due to the nature of Ghana’s economy and state of investment culture. Although investing for the future is of great concern to Ghanaians, low income levels and the lack of trust in the system due to mismanagement of the economy, a poor exchange rate and strength of the currency have made pushing an agenda for a solid investment culture a daunting task.

In a 2023 Ghana Earnings and Savings Survey, 39% of respondents had savings equivalent to zero months of their expenditure. Only 30% of respondents had savings that could cater for over three months of their monthly expenditure.

If these Ghanaian respondents had to lose their current source of income, a whopping 70% would have to rely on external sources of income as their savings will not suffice for more than three months.

This lack of safety net in terms of savings is highlighted and contextualized in another worrying data set about earnings. According to responses from the Ghana Earnings and Savings Survey, over half of respondents (55%) earned less than GHc5000 with 26% earning less than GHc2500 a month. Although investment is a skill that has to be developed over time, these troubling statistics cannot be overlooked in the analysis of Ghana’s investment culture.

Jerome Kuseh is a chartered accountant and financial analyst who led the Ghana Earnings and Savings Survey. On Ghana’s investment culture as a nation, Jerome describes it as ‘underdeveloped’.

“Our rate of savings is low due to low income, a high rate of inflation and a high rate of underemployment. Without developing adequate private capital, it is difficult to build a robust investment culture,” he explains.

Domestic Debt Exchange Programme

By January 2023, the enthusiasm for Ghanaian youth to invest had hit rock bottom due to effects of the Domestic Debt Exchange Programme. The pointers for investment advocates before then had been partly reliant on saving for a time of need or old age.

Aside from the fact that people had lost sums of money as part of investment related risks due to the Securities and Exchange Commission’s enforcement of amortized value and market-to-market value, liquidity for these investments had been a challenge for customers who needed their money. The situation was so bad that fund management company Databank closed their offices for remote work due to physical and verbal attacks on their staff by some clients.

In a statement released by the fund management company, Databank wrote:

“Many of our clients have tried to be patient with us as we wait for the government to provide liquidity. For this, we are extremely grateful. However, there are several clients who have felt the need to abuse our staff physically and verbally, and also threaten their lives as well as their families. As such, we have no choice but to move to a work-from-home option.”

Pensioners were not exempt from these challenges. On May 10, 2023, Members of the Pensioner Bondholders Forum picketed at Ghana’s Finance Ministry for a third time, demanding payment of their outstanding coupons and principal on their bonds. These pensioners included Ghana’s former Chief Justice Sophia Akuffo showing the range of how anyone in the country could feel the effects of a struggling economy.

“It’s devastating,” Jerome Kuseh says about the long-term impact of Ghana’s Domestic Debt Exchange Programme.

“It was already difficult to convince Ghanaian youth, many who are in precarious financial situations, that stocks, bonds and treasuries were viable means to build wealth over time when they saw their colleagues claim to get rich out of day trading or gambling.

“The DDEP has calcified the belief of many youth that traditional financial securities cannot help them,” Jerome adds.

For Desmond Bredu, there is a personal perspective to the effects of the DDEP in relation to him promoting and educating on personal finance management and giving lessons on investment for young Ghanaians.

“On a personal level, you have people point fingers at you for encouraging them to invest. Some will tell you they would have been better off if they had squandered the money instead of choosing to invest,” he discloses.

The lack of trust in investments in Ghana, however, cuts across from different experiences. “There is an increased reluctance to invest in these times. Investor confidence has significantly dropped post the DDEP. For some investors, confidence or optimism for a possible future recovery is nonexistent,” Desmond adds.

For both Jerome and Desmond, these indicators and investor reactions are not dead ends. Jerome explains that it is possible to restore confidence if the government honours all the commitments made with respect to the new bonds issued under the DDEP and the bonds that were exempted from the DDEP. Desmond adds that with the right management of the situation, the aftermath of the IMF deal will bring some stability to Ghana's currency and reset the general interest rates - factors that will be beneficial to economic growth because business and individuals can borrow at reduced rates.

A gloomy investment future of hope

Without a doubt, the Domestic Debt Exchange Programme has cast a shadow on the willingness of the average Ghanaian youth to trust investment schemes. Convincing people to invest is ‘a hundred times more challenging before the DDEP’ according to Desmond who teaches and preaches financial literacy.

However, this is not a reason to make challenging investment times a permanent lack of investment habit. There is always a way and both financial experts share their view on some investment opportunities for Ghanaian youth moving forward.

“The first thing they (Ghanaian youth) need to do is invest in themselves,” Jerome advises. “They need to invest in their income earning capacity by learning skills by themselves online. It’s unfortunate that there’s such a high level of competition in the job market but that’s not going to change, so they need to stand out.

“The next thing is to find well-managed mutual funds that would allow them to gradually build an emergency fund and capital for riskier investments.

“Once emergency funds are built, they can talk to licensed brokers about using some excess savings for buying stocks and REITs (Real Estate Investment Trusts). Since they are young, they have a longer investment timeline and can take more risks than older people.

“Finally, they need to contribute to the national pension system whether they are employed or not. Contributing at an early age, even at low income levels, plays a significant role in the sums they’ll get after retirement,” he says.

“We encourage people to take time to understand the investments they want to venture into, whether traditional or alternative,” Desmond adds on solutions around encouraging young Ghanaians to invest.

“Investors are encouraged to ask as many questions as possible. Regardless, it is also crucial that we highlight the presence of risk in every form of investment that one may undertake.

“As an industry, it is also vital that we take the lessons from the DDEP and innovate to bring different solutions or products that meet specific investor needs.

“Finally, investors need to keep only some of their eggs in one basket and diversify their investments such that a downturn of one will not significantly impact their financial well-being,” he shares.

Investment scenes and the banking sector in Ghana have their ups and downs. Just like the banking sector clean-up in 2017 and 2018, this too shall pass on a national economic struggle level. On an individual level, young Ghanaians have to find a way to safeguard their financial security for the future. Desmond puts it in plain terms.

“It is essential to highlight that just like life, where there are up and down moments, a similar scenario also happens with the markets. They go through a cycle: good times and bad times. We are currently in a downturn, and for some investors, it is even the opportune time to stay invested or invest more. You should speak to an investment advisor before deciding in this environment.”

This is the story of the impact of the Domestic Debt Exchange Programme and its ripple effects on Ghana's fractured investment culture and economy.

)

,fit(112:112))

,fit(112:112))

,fit(112:112))

,fit(112:112))