Akufo-Addo extends Auditor General's appointment for 2 years

)

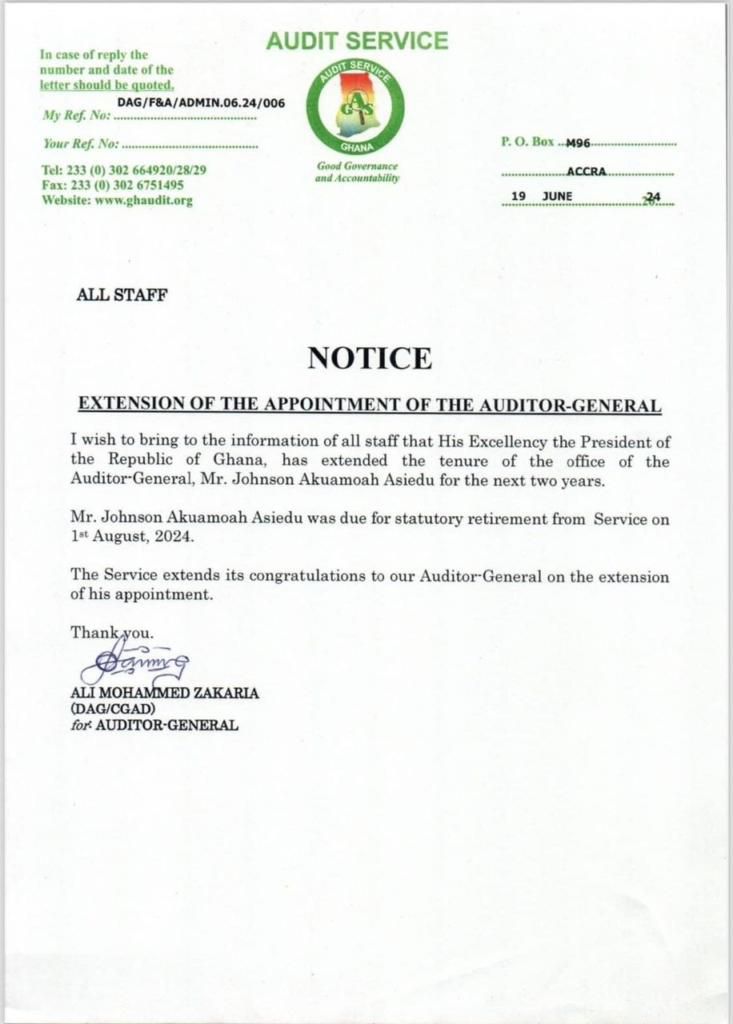

This extension was announced in a notice from the Audit Service dated July 19, which was addressed to all staff.

According to the notice, Mr. Asiedu was originally due for statutory retirement on August 1, 2024.

The Audit Service congratulated the Auditor General on the extension of his appointment.

“I wish to bring to the information of all staff that His Excellency the President of the Republic of Ghana, has extended the tenure of the office of the Auditor General, Mr. Johnson Akuamoah Asiedu for the next two years,” the notice read.

“Mr. Johnson Akuamoah Asiedu was due for statutory retirement from Service on August 1, 2024. The Service extends its congratulations to our Auditor General on the extension of his appointment. Thank you,” they added.

READ THE STATEMENT FROM THE AUDIT SERVICE BELOW

)

)

)

)

)

)

)

)

)

)

,fit(112:112))

)

,fit(112:112))

)

,fit(112:112))