Ecobank Ghana retains top spot in Ghana's banking sector despite challenges

)

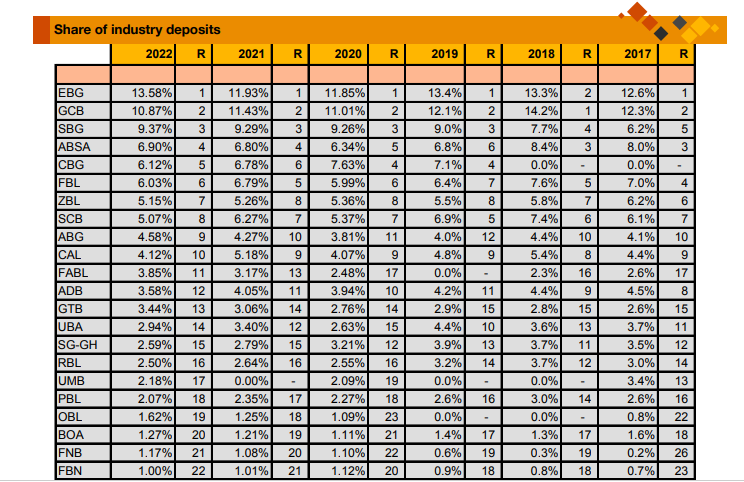

This data was revealed in the 2023 Ghana Banking Survey conducted by PricewaterhouseCoopers (PwC). The bank's market share in terms of the industry's deposits improved compared to the previous year, surpassing the 11.93% recorded in 2021.

Following Ecobank Ghana, GCB Bank secured the second position, but it experienced a slight decline in market share concerning the industry's deposits. In 2022, its market share stood at 10.87%, slightly lower than the 11.43% recorded in 2021. A trend analysis revealed that GCB Bank has been consistently losing market share since 2017.

Stanbic Bank Ghana (SBG) maintained its third position in terms of the industry's deposits and exhibited continuous growth in its market share of customer deposits year-on-year. Absa Bank Ghana retained its fourth position from the previous year and also saw a marginal increase in its market share by 0.1%.

Consolidated Bank Ghana made significant strides, advancing from the 6th to the 5th position, overtaking Fidelity Bank in the process. However, its total percentage of deposits in the industry decreased in 2022.

The top 10 banks in terms of industry deposits at the end of 2022 were Fidelity Bank Ghana, Zenith Bank Ghana, Standard Chartered Bank, Access Bank Ghana, and Cal Bank, apart from the aforementioned top four.

Notably, the banking sector experienced a remarkable surge in deposit growth, recording a staggering 31.3% increase at the end of 2022, more than double the growth observed in 2021, which was 12.1%. This growth signals a positive trend in the sector, reflecting increased financial activity and public trust in banks.

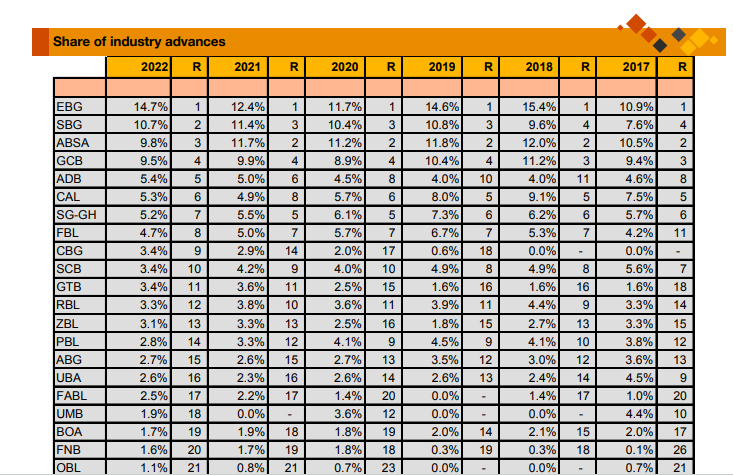

In terms of industry loans, the services, commerce, and finance sectors dominated, accounting for 41% of the total industry loans and advances, with 24% and 17%, respectively. The total loans and advances from these sectors increased by ¢6.61 billion.

The Ghanaian banking sector continues to navigate challenges, including economic fluctuations and the impact of government policies, but remains resilient in meeting the financial needs of the nation.

Ecobank Ghana's continued dominance and the growth observed in the banking industry's deposits underscore the sector's potential for further expansion and development.

PwC's Ghana Banking Survey provides valuable insights into the dynamics of the banking industry, allowing stakeholders to make informed decisions and strategize for the future. As the economy continues to evolve, banks will need to adapt and innovate to maintain their competitiveness and drive sustainable growth.

The data from the survey will undoubtedly serve as a guiding tool for industry players and regulators alike as they steer the banking sector towards stability and prosperity.

,fit(112:112))

,fit(112:112))

,fit(112:112))

)

,fit(112:112))

,fit(112:112))