Advertisement

GHc600m COVID-19 loan: Here's how gov't intends to disburse it to businesses

)

Ken Ofori-Atta

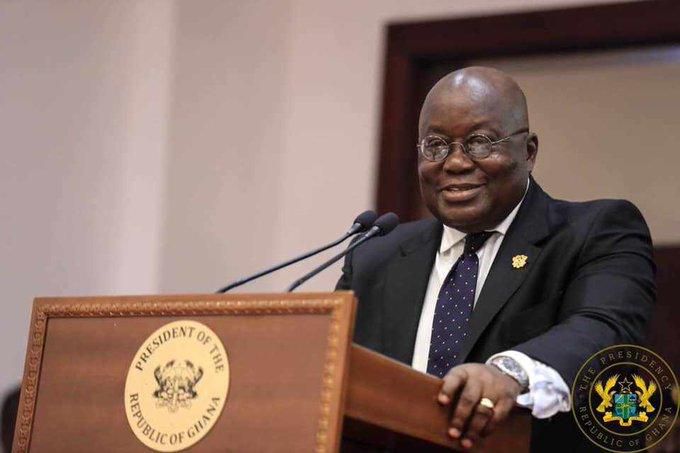

President Nana Addo Dankwa Akufo-Addo, on April 5, in an update on government's mitigating efforts to businesses on COVID-19, announced a GHc600m soft loan package for small and medium scale enterprises.

Advertisement

The president admitted the challenges most businesses are facing during this pandemic, therefore, the need for support from government.

Advertisement

Though the scheme was announced over a month ago, businesses are yet to access the loans across the country.

President Akufo-Addo

According to the National Board for Small Scale Industries (NBSSI), documentation for the disbursement of the GHc600 million soft-loan scheme pledged by government to alleviate negative impacts of the COVID-19 pandemic on small scale businesses across Ghana has begun.

NBSSI’s Executive Director, Kosi Yankey-Ayeh estimates businesses will receive the loans from this month.

Advertisement

We, therefore, took a look at how government intends to disburse it:

- The loan comes with a one-year moratorium: This means businesses who access this facility will have a period when they will not be obligated to make payments.

- Borrowers have a 2-year period to pay back the funds granted to them.

- The scheme will be regulated by government in collaboration with the National Board for Small Scale Industries (NBSSI), business and trade associations and selected commercial and rural banks.

- Prospective applicants must be duly registered, in addition to having Tax Identification Numbers (TIN), among other eligibility criteria.

- To ensure transparency and that only deserving businesses benefit from the support, an online application platform will be used by applicants.

- A committee comprising private sector players and various business associations will review, assess and identify the needs of all applicants.

Advertisement

Subscribe

Sportal WhatsApp

Advertisement

More from Pulse Ghana

Advertisement

)

)

)

)

)

)