If the answer is no, then we are here to inform you that it is very easy to calculate your income tax in Ghana.

Ghana has a very friendly income tax system, in that the more you earn, the more taxes you pay and that seems to favour the low and middle-income workers a bit.

The income tax law also aims to secure the futures of workers by assuring them of investments for old age.

The income tax in Ghana varies for residents from 5% to 30%, while that of non-residents is a flat 25% on their chargeable income.

The Commissioner-General of the Ghana Revenue Authority (GRA) early this year made some amendments to the Income Tax Act, 2015 (Act 896) by the Income Tax (Amendment) Act, 2019 (Act 1007).

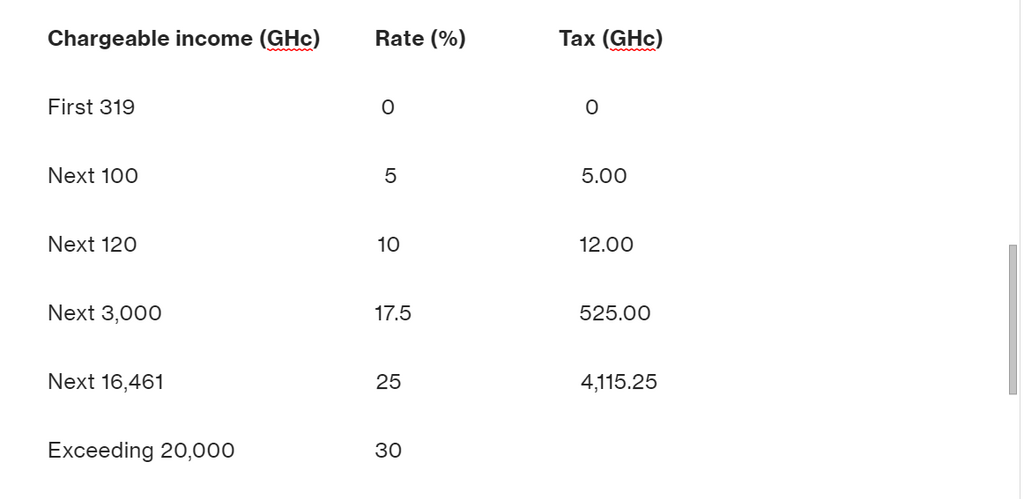

Meanwhile, persons whose monthly salaries are below GHc319 are not taxed.

Here’s how your income tax in Ghana is calculated, as per the GRA:

Monthly income tax rates:

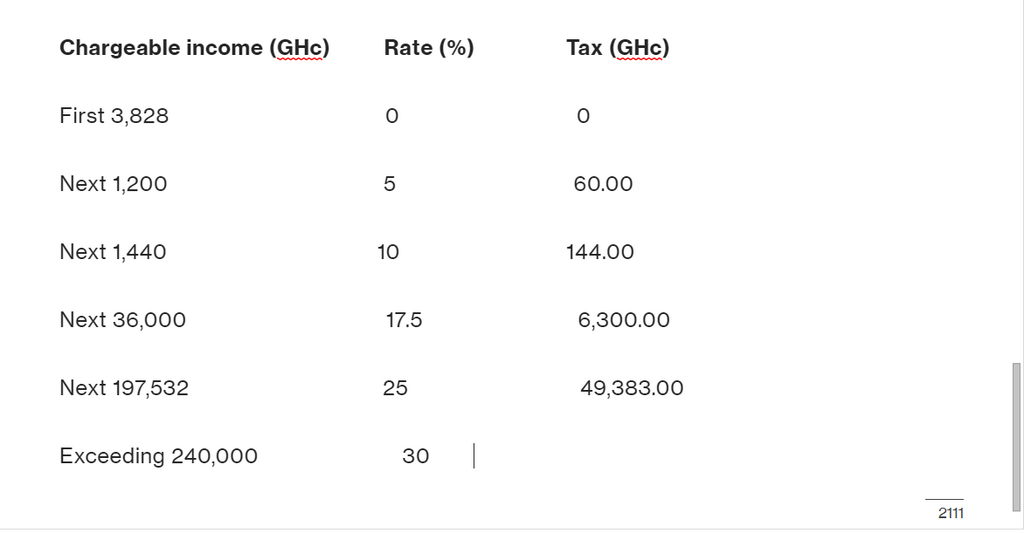

Annual income tax rates:

)

,fit(112:112))

)

,fit(112:112))

,fit(112:112))

,fit(112:112))

,fit(112:112))