Reading the Market's Pulse: How to thrive with price action strategies

)

Navigating the financial markets could be as difficult as trying to predict the weather. While the meteorologists use patterns to tell them when a storm may be brewing, it is the price chart of the market that a price action trader would use to decide how and when to trade. The basis of price action trading lies in the ability to read what the price movements are saying by filtering off lagging indicators, thus allowing the trader to make quick and accurate decisions. This enables traders to often have an edge over other traders who rely too much on technical indicators.

A price action trader is in constant association with charts, looking carefully at every candle and bar for a possible signal. These signals are the very foundation of any price action trading strategy, helping a trader zero in on high-probability setups. If understood correctly, price action enables traders to read the pulse of the markets with ease and to position themselves in trending and range-bound markets.

Mastering the Basics of Price Action Trading

Price action trading involves analyzing the movements in price of a security over some time. Unlike strategies based on technical indicators, techniques of price action trading do not regard tools aiming to represent a clearer view of market behavior. The former is of benefit in honoring psychology that drives participants within markets and hence a favored method for those looking to be more intuitive in trading. For those just starting off or looking to increase their working capital, researching offers on the likes of deposit bonuses and Forex cashback can further equip you with resources to support your price action strategies.

Key considerations in price action trading include elements such as support and resistance. Traders determine this from very basic charts and get levels that establish clear delineations across which price tends to churn or even reverse any moves. Such knowledge may help traders in setting up a possible price break or even a reversal. In employing price action strategies, it is key since it sets a precedent under which the traders can make decisions based on the previous patterns of prices. Understanding these basics is the first step toward making a profit with price action trading.

Decoding Price Action Signals: The Trader's Compass

One has to know different types of signals in price action that give him cues for possible trading opportunities upon delving in one of them. Such signals happen to be a pin bar or an inside bar pattern; visually, they indicate a possible change of direction in the market sentiment or even warn about an impending change in the direction of trends. For instance, the pin bar pattern tends to be one of the very common price action setups that indicate a reversal, often formed at key support or resistance levels.

Adding these would significantly enhance your probabilities of rendering future price movements by combining them with your implemented price action trading strategy. The beauty behind price action trading is its simplicity. Focusing just on how the shape and position of candles score on a price chart, most of the other racket produced by tools for contributing to technical analysis is ignored. Among these, for one desiring to thrive in this domain, the understanding of these signals and how they fit into the broader context of price action strategies is important.

Building a Solid Price Action Trading Plan

Outlining a plan for a successful Price Action trader wouldn't only be reacting toward price action; it is a clearly defined plan of action, usually including precise entry and exit rules, risk management, and position adjustment in light of altering market conditions. An important part of the plan identifies areas on charts at which price is probably going to respond to, such as vertical support or places of strong trend.

Important Elements in a Price Action Trading Plan:

- Entry and Exit Rules: Determine when positions are to be entered and exited based on concrete price action patterns.

- Risk Management: Establish predetermined stop-loss levels to minimize the possibility of losses that could harm your trading equity.

- Position Sizing: Determine how much of your capital you want to put at risk per trade, such that your exposure in the market will always be controlled and consistent.

- Market Conditions: Determine whether the market is trending or range-bound and adapt your strategy accordingly.

The structure given in price action trading helps a trader to stick to discipline and being focused, reducing the chances of making emotional decisions. Through this strong trading plan, a trader consistently sails through all the puzzles the forex market and indeed any other financial market may throw.

Support and Resistance in the Context of Price Action Trading

Support and resistance levels are the cornerstones of price action trading. This really will be around the pricing spreadsheet the place price has been seen to get difficulty not to shatter or clutter through. For example, support price is where a currency pair has seen enough buying interest in the past to be able to stop it moving to any new low level. Resistance demonstrates a point where enough interest in selling has been strong enough to mention stop to a rise in price.

Traders in price action watching such levels can be said to be characterized by the anticipation of potential price breaks or reversals. But, of course, such insight has very significant value in trading Forex, where price activities can reflect sentiment by the accumulating actions toward a currency pair. This information can easily be used by traders themselves to position their trades in the direction of the trend, or in preparation for a possible reversal when the price approaches support or resistance levels. Whoever has learned and started applying these important concepts is bound to be successful in price action trading techniques.

Trading Price Action Patterns: A Practical Approach

Price action trading is not all about just reading the price charts; it is about identifying and trading the formed patterns in price action that have a high probability to work. Clues to what the market intends to do include the pin bar and inside bar; for example, a pin bar pattern usually indicates a reversal, especially when it is formed at a key horizontal support level or resistance level. Nevertheless, the inside bar pattern signals a consolidation and may break out in either direction.

Good price action traders develop an eye for these patterns; they figure out the right time to commit and when to wait. Through conquered trade setups, price action traders can take more informed and confident trading decisions. It is this hands-on practical approach to price action trading that really makes the difference between people who survive in this game with some success and those who just barely eke out an existence.

Price Action Common Patterns and Their Meaning

Among the many common price action patterns that give away valuable information about the market's behavior, there are two that are more traded than others by price action traders: the pin bar and inside bar patterns. The pin bar is usually considered to be one reversal signal, with its long wick and small body, especially at key support or resistance levels. The inside bar pattern, on the other hand, is a pattern of consolidation and consequent breakout that very often leads to a big move in price.

Through the recognition and comprehension of such patterns, a trader can make more valid decisions in the forex, and thus have a higher chance of success. One should not forget that though these patterns are powerful tools, they should also necessarily be analyzed in the context of a broader market environment. It's this complete approach that makes price action trading effective at capturing the feel of the market.

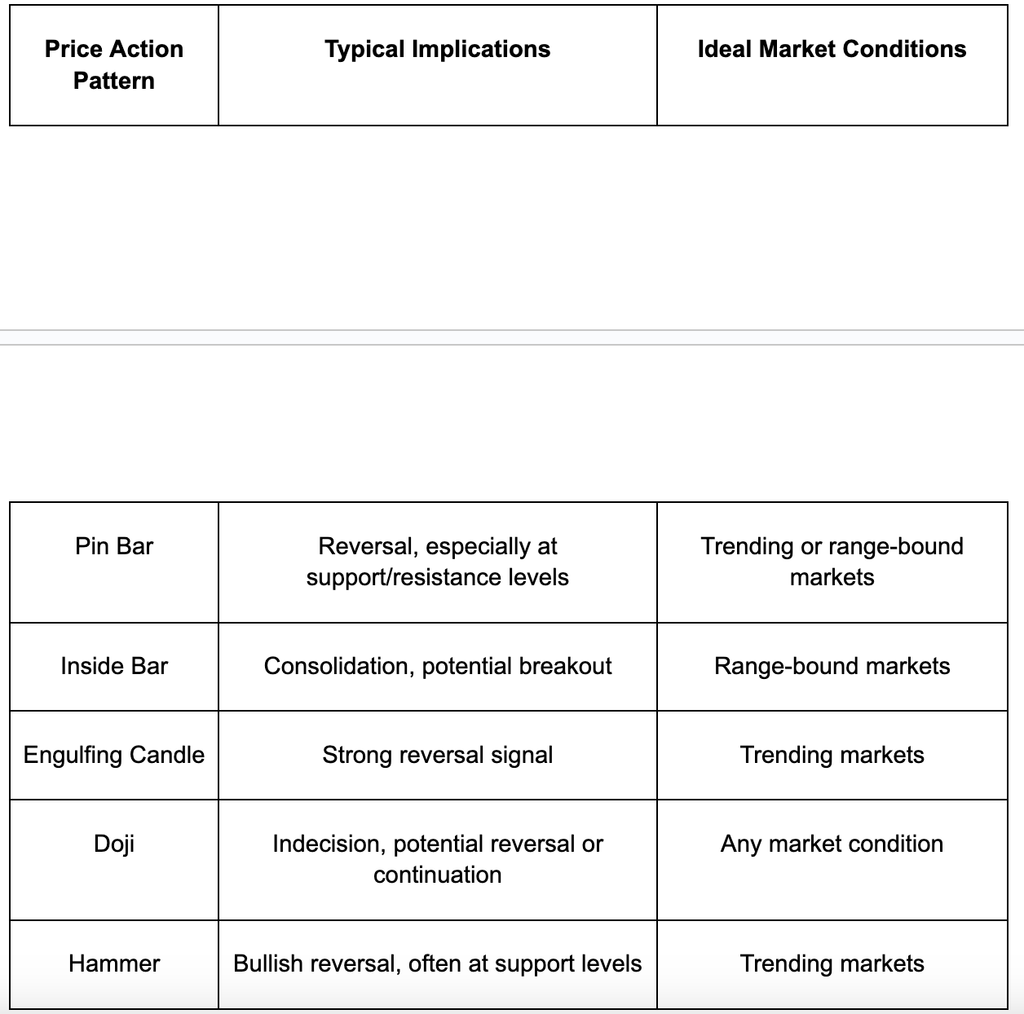

Key Price Action Patterns and Their Market Implications: A Quick Reference Table

The following table demonstrates some of the most critical key price action patterns, along with their typical implications and ideal market conditions, for the sake of easy identification:

This table can be used as a reference tool for the traders in spotting and assessing the most important price action patterns. These enable the traders to enrich their trading strategies with the appropriate tools to make effective and timely judgments.

Fundamentals in Price Action Trading

Although price action traders observe only price movements, it should not be neglected that, due to fundamental reasons, price action in the market can change dramatically. For example, through important economic data releases, geopolitical events, and central bank policies, major currency pairs could swing dramatically by providing large price breaks or strong reversals.

The price action trader should be aware of these fundamental factors in order to provide context for the price action on charts. By incorporating the knowledge of these fundamental factors, it helps price action analysis make more complete and informed trading decisions. This holistic approach is supposed to be essential for traders when trying to navigate the complexities involved in the forex market and in attaining long-term success.

What Are Advanced Price Action Trading Strategies?

The more advanced strategies involve trading price action setups that encompass multiple price action patterns to serve as additional confluence. An example of this is a pin bar setup at a key level of resistance succeeded by an inside bar; sure enough, it constitutes a very strong downside reversal signal.

This further gets complex when using price action to trade breakouts from within consolidation areas. Identifying a series of price patterns that set up a pressured building situation—like an inside bar or a chain of tight-range candles—affords the trader the opportunity to capitalize on the following breakout. These strategies are advanced and require an in-depth understanding of price action, along with the ability to think and infer creatively in relation to market behavior.

What Makes Price Action So Relevant to Forex Trading

Price action trading is best efficiently done in forex trading since with currency pairs, there would barely be any price action without clear, coherent, and predictable movement. Concentrating more on the price action of currency pairs, a trader would be in a position to spot key support and resistance levels, possible breaking in a price, future price breaks, and generally predict future price moves.

That was the main advantage that price action Forex trading has in terms of flexibility: in all sorts of market conditions, whether trending or going range-bound, proper analysis of price history and the correct trading strategies allow one price action trader to always find a way to profit from a trade. For exactly this flexibility, price action trading becomes an extremely powerful tool in navigating the Forex market.

Retail Traders and Price Action Trading

Retail traders, particularly, would highly benefit from using price action trading techniques. Just to note, institutional traders have access to fast and efficient algorithms with platforms for high-velocity trading; therefore, it is a phenomenon that retail traders have basic and available methods to resort to. Price action trading is just that, as it takes just some basic understanding of price charts, basically the ability to spot important price action.

The retail trader can level off the field through concentrating on price action consistently taking place in the forex market. That is why the simplicity and effectiveness in price action trading is most suitable for traders who would wish to go further in understanding the markets in order to make their career in trading highly rewarding and beneficial. Retail traders, with time and practice devoted to it, can very often harness the use of price action to produce constant and profitable results.

The Future of Price Action Trading within the Financial Markets

As financial markets continue to evolve, price action trading remains both up-to-date and forceful for traders of any level of experience. The principles of price action trading are timeless; they are based on fundamental dynamics of supply and demand, which fuel market movements. New trading technologies and strategies are bound to come up, but the simplicity and effectiveness of price action trading ensure that it retains its value as a cornerstone of successful trading practices.

The price action traders, and successful master traders of this subject, always win in this period of tremendous changes in the financial markets. By just sticking to the principles of price action basics and being dedicated in scaling up expertise continually, a trader can weather market challenges and become successful, standing the test of time.

#Featuredpost

)

,fit(112:112))

,fit(112:112))

)

)

)